September 2019 – As you saw from our recent press release, we have now formalized our relationship with Kent Periscopes and G&H Aerospace and Defense. We believe this relationship will benefit both companies by allowing those customers who prefer the cost, weight, and performance advantages of acrylic periscopes to have a clear path towards the same reliable products used by the United States Department of Defense on all major armored vehicle platforms. G&H demonstrated one of our periscopes at the recent DSEI show in London, and together, we answered potential customer’s questions and concerns. Our expectation is to start taking orders from G&H in early 2020 and begin shipments in the second half of 2020.

Attracting and retaining the correct employment levels has been a challenge which we’ve been addressing during the last 12 months. The Dallas area recorded a 3.1% unemployment rate in July 2019 compared to 3.4% for all of Texas and 3.7% nationwide. We continue to adjust wage and benefit levels to attract and retain talent and align our production costs with the customer’s expectation on price control. Our customers understand these issues, and we continue to work with them on price and delivery expectations to keep their inventory at an acceptable level. These same issues have plagued some of our suppliers who have also, in turn, reacted to these market issues and made corrective actions in their ability to improve delivery numbers to us.

Finally, a shareholder recently asked us to more clearly explain the Warrants and our expectations as those Warrants head towards maturity in August of 2021. First off, the full terms of the Warrants can be found in the S1/A filed on 8/22/2016 Exhibit 4.2.1 at the following link: https://www.sec.gov/Archives/edgar/data/1397016/000161577416006908/s103962_ex4-2×1.htm. Given that very few Warrant holders have exercised their options, it’s our opinion that most, if not all, will wait for the Warrants to mature and then take advantage of the cashless exchange from a Warrant to a Share upon termination as described in section 2(c) of the Purchase Warrant Agreement.

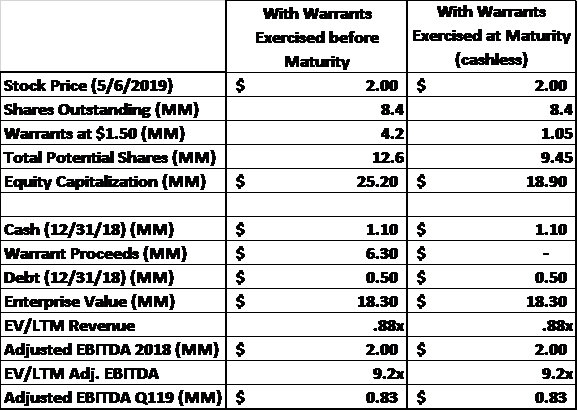

In our May Investor Presentation, https://www.optexsys.com/downloads/OPTEX_Overview_5-6.pdf, we gave an example of what the dilution might look like if the stock was at a $2.00 price point. Here’s a copy of that chart from page 13.

In this example, if the Stock price is $2.00, the resulting dilution is 1,065,197 shares (calculated by taking (($2.00 – $1.50) * 4,260,785) / $2.00 = 1,065,197 new shares). The Warrant holders’ other choice is to pay Optex $1.50 and receive a Share, which would then generate $6.3 Million in Cash for Optex. The end result will lie in the middle, but it’s our opinion that most will wait for the cashless option and the dilution to existing shareholders will have little to no effect. The Enterprise Value remains the same, the Enterprise Value divided by Last Twelve Months Revenue remains the same, and the Enterprise Value divided by the Last Twelve Months Adjusted EBITDA also remains the same.

With that said, we do not like the SEC requirement of reporting the non-cash “Gain (Loss) on change in Fair Value of Warrants” on our Income Statement. We believe this potentially scares away new investors who potentially haven’t researched this value and what it actually means as to the performance of Optex. Therefore, Optex will continue to look for opportunistic Warrant buy backs as an effective use of excess cash.

We understand that our third quarter performance was below the market’s expectation, but we continue to see increased revenue, increased gross margins, and increased earnings. Our backlog is strong and we look forward to working with G&H to expand our served market beyond the Americas.

Danny Schoening

CEO